California Exempt Salary 2025. The new minimum salary for these employees will be $83,200 per year. California voters in november will see a ballot initiative that would raise the state minimum wage to $18 an hour.

For those who are properly classified as exempt “computer professionals,” the minimum salary amounts are increasing for 2025 as follows: 1, 2025, the california state minimum wage will increase to $16 per hour for all employers, regardless of employee headcount.

California voters in november will see a ballot initiative that would raise the state minimum wage to $18 an hour.

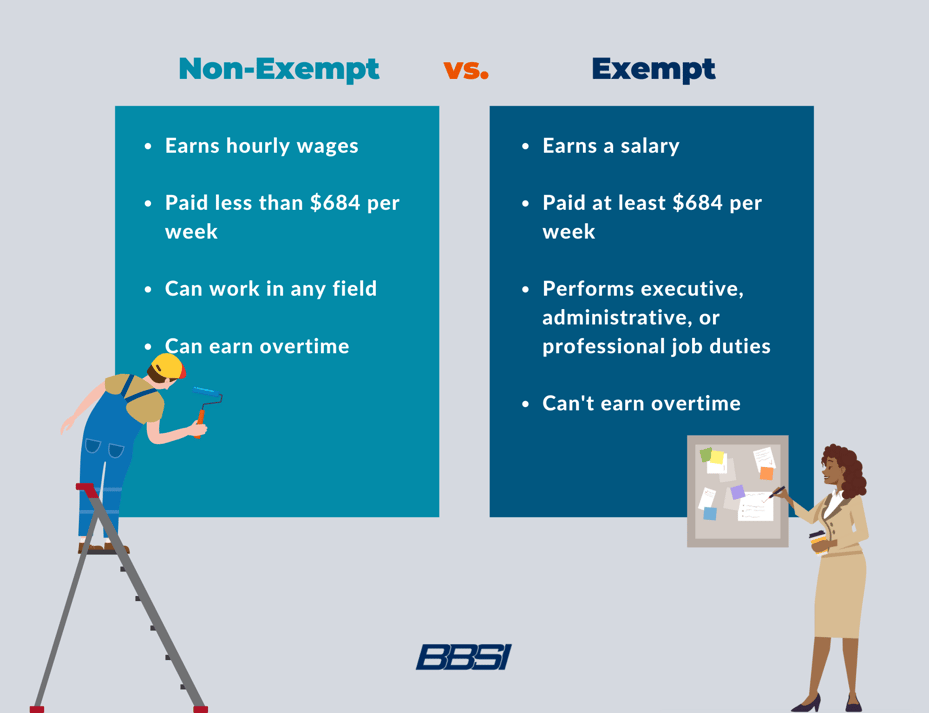

As of january 1, 2025, to be considered an exempt employee in the u.s., a worker must be paid a minimum salary of $684 per week, or $35,568 per year.

Overtime Rules To Change in 2025 Fingercheck, It’s backed by billionaire joe sanberg. 1, 2025, the california state minimum wage will increase to $16 per hour for all employers, regardless of employee headcount.

Exempt vs NonExempt LedgerGurus, As of january 1, 2025, to be considered an exempt employee in the u.s., a worker must be paid a minimum salary of $684 per week, or $35,568 per year. The new minimum salary for these employees will be $83,200 per year.

How to Avoid the 7 Biggest Exempt Employee Classification Mistakes, The current exempt minimum salary sits at $64,480 per year. As of january 1, 2025, to be considered an exempt employee in the u.s., a worker must be paid a minimum salary of $684 per week, or $35,568 per year.

Exemption California State Tax Form 2025, Exempt employees (administrative, executive, and professional) must earn at least two. As of january 1, 2025, employees in california must earn an annual salary of no less than $66,560 to meet this threshold requirement.

California State Exempt Form For Non Profits, Unless otherwise noted, these laws take effect january 1, 2025. As a result of a change in the.

California Exempt Employee Minimum Salaries and Wages C2 Essentials, Inc, The new minimum salary for these employees will be $83,200 per year. Starting january 1, 2025, california employers must pay their computer professional employees a salary of at least $115,763.35 annually ($9,646.96 monthly) or.

California Taxexempt Form 2025, Employers also must keep in. For those who are properly classified as exempt “computer professionals,” the minimum salary amounts are increasing for 2025 as follows:

What Is The Minimum Salary To Be Exempt From Overtime In California, 1, 2025, the california state minimum wage will increase to $16 per hour for all employers, regardless of employee headcount. Effective january 1, 2025, california’s minimum wage will increase to $16.00/hour.

EXEMPT VS NONEXEMPT IN CALIFORNIA 2025 PERSPECTIVES Employers Group, The california minimum wage will increase to $16.00 per hour. This increase is happening because under california law, eap employees must earn a.

Employment Offer Letter Exempt or Non Exempt Form Fill Out and Sign, The 1/1/24 increase means that as of january 1, 2025, exempt employees must earn a minimum of. Starting january 1, 2025, california employers must pay their computer professional employees a salary of at least $115,763.35 annually ($9,646.96 monthly) or.